Eight months after the coronavirus plunged our nation into a largely remote reality, we have witnessed an accelerated shift to a digital world. As our modes of working, shopping, eating, living, transacting and communicating have transformed, we have focused on helping businesses adapt to a world that has fundamentally changed.

G&S conducted a nationwide study among consumers in October 2020 to understand just how much COVID-19 has impacted their lives in connection with the basic necessities, from food and shopping to banking and healthcare. The big question: What’s gone forever, and what’s here to stay? Over the next few months, we will explore the trends that are reshaping our future, including the behaviors that emerged during the COVID-19 pandemic.

We begin with a look at digitization across food, health, finance, home and the supply chain.

Grocery Delivery: A Passing Fad?

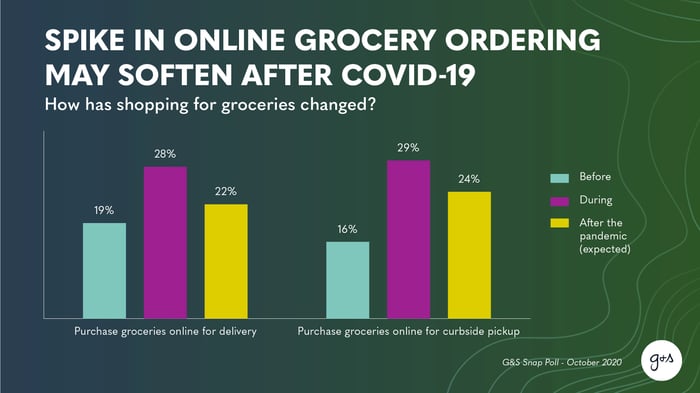

With over half (51%) of consumers surveyed somewhat concerned about contracting the virus through the food they eat and 58% concerned about contracting it through food packaging, online grocery ordering has seen a marked increase in both curbside pickup and delivery. Purchasing groceries online for delivery jumped in popularity from just 19% of consumers in a pre-pandemic world to 28% during the pandemic, while the increase in ordering for curbside pickup was even more pronounced (from 16% to 29%).

Consumer concerns about contracting the coronavirus through their food and/or food packaging seem to trend downward among older respondents, suggesting that younger consumers are more attuned to risks of exposure. Interestingly, while stores across the country have set aside dedicated “senior hours” for older consumers to shop and purchase groceries, it may be the younger consumers to whom companies should target their the next wave of communications about the safety protocols set in place to protect their food supply.

The introduction of curbside pick-up may have sustained countless retailers who, according to The New York Times, were able to entice consumers to leave their homes to participate in the safely-distanced yet still personal shopping experience they craved.

Yet the shift to online grocery ordering is not for everyone, and not necessarily forever. Particularly when it comes to food, consumers may simply prefer to shop in person – and with the percentage of those who expect to continue ordering groceries online for delivery and pick-up in the post-pandemic world revealing a slight drop (6% and 4%, respectively), this may be one trend shoppers prefer to abandon in cart.

Contactless Payments See a Surge in Adoption

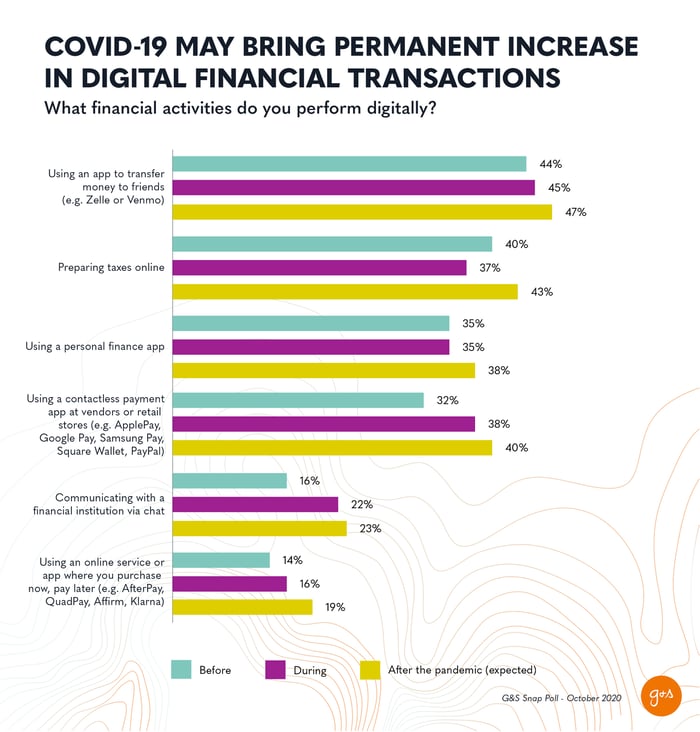

While many consumers have grown accustomed to using digital finance tools, the coronavirus has further driven fintech adoption. Thirty-eight percent of consumers reportedly began regularly using contactless payment apps, like Apple Pay and Square Wallet, during the pandemic, compared with 32% before the pandemic hit.

Consumers also became more comfortable communicating with their financial institutions via chat during the pandemic. Twenty-two percent of those surveyed say they regularly communicated with their bank or financial institution via chat, up from 16% in pre-pandemic times.

The pandemic has accelerated a digital shift in consumer finance already well underway. Yet, as Managing Director Anne Green writes, “There are clear leaps to be made to hit today’s bar of expectations driven higher by COVID-19.” At a time when many financial services firms have struggled to navigate the “last mile” of digital transformation, investing in digital development of services to meet consumers’ needs in this virtual environment has become more important than ever.

Other trends, like “buy now, pay later” tools and apps that enable consumers to share expenses and transfer money to friends, are also gaining ground. Even with the reemergence of outdoor dining in some states, consumers are taking advantage of contactless options to avoid money literally changing hands.

Telehealth Trends Up

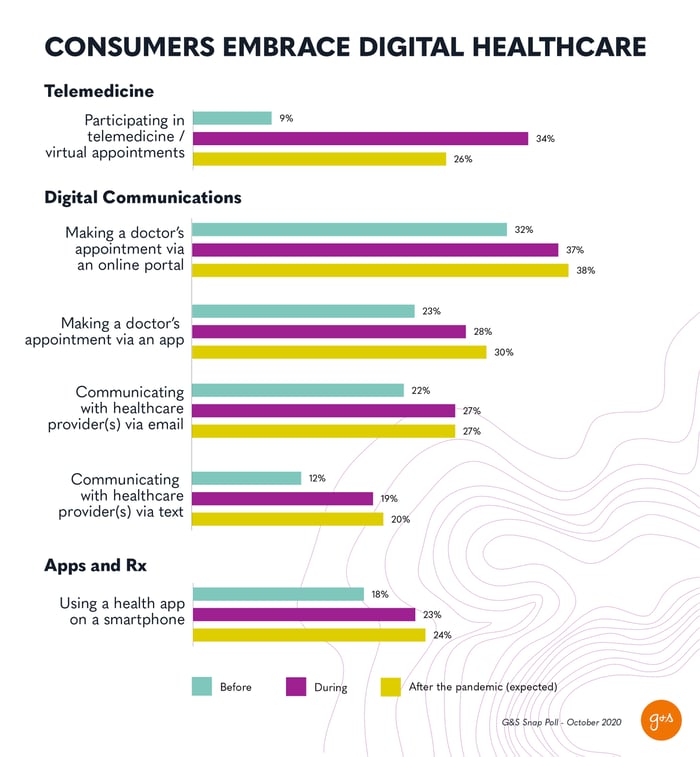

Perhaps unsurprisingly, reliance on telemedicine surged among consumers during the pandemic, with 34% saying they participated in telehealth or virtual consultations compared with 9% pre-pandemic. While leveling off, the use of telehealth services will remain a viable option for many consumers post-pandemic, with 26% planning to take advantage.

“While we saw a major increase in telehealth usage at the beginning of the pandemic, patients are now feeling comfortable returning to in-person visits,” says Senior Vice President Rachael Adler. “It will be imperative for hospitals and health systems, along with telehealth companies, to strike the right balance between the two, determining which conditions require in-person attention and which cases can be handled with a virtual visit. The right combination will help increase access to care while also managing costs for both the patient and the provider.”

When it comes to health-related communications, consumers are growing increasingly comfortable relying on digital services to connect with both physicians and insurance companies, realizing the convenience and commitment to safe practices during the pandemic. The use of apps, email, texts and online portals has grown considerably during the pandemic and will likely remain the norm for many consumers moving forward.

Prescription medicine has also shifted to a digital-first, remote delivery model, with nearly a quarter of American consumers saying they expect to continue to order online and/or receive medications via delivery for the foreseeable future.

The United States of Shipping

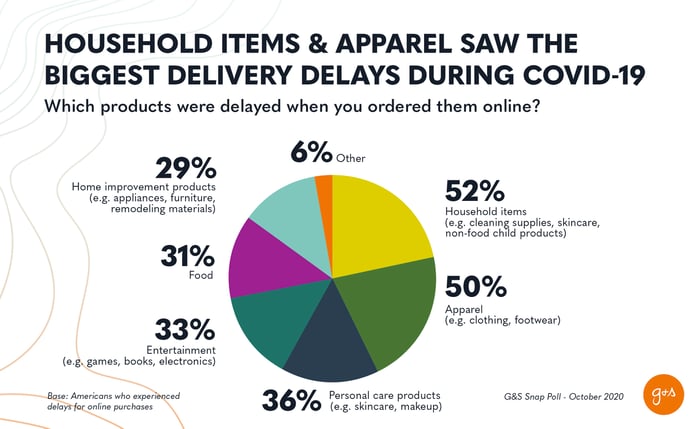

As deliveries proliferated during the pandemic, so did delays. Over half (56%) of Americans increased their online ordering and delivery frequency during the pandemic, and 60% reported experiencing delays in shipments, with household items and apparel topping the list of items to arrive behind schedule.

Among those who experienced delays for online purchases, almost half (45%) say shipments delays have gotten better compared to March and April – though a third (33%) say they have gotten worse.

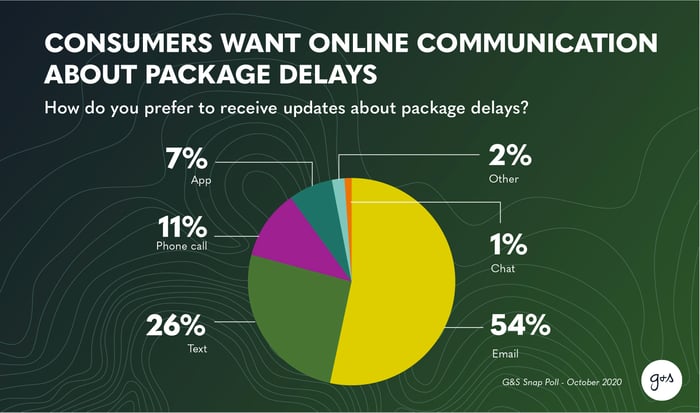

The average consumer expects companies to communicate with them about delays in shipments, particularly for food and home improvement items. More than half (54%) prefer to receive email communications about these updates, while one fourth (26%) prefer to hear about delays via text messaging.

The Remote Home: Consumers Still Expect a Personal Touch

In a world of social distancing and digital shopping, certain purchases still require a personal experience. Nowhere is this more evident than in the highly personal space of the home, which has taken on an even greater focus in consumers’ lives as the pandemic forced more and more activities – from work, child care and education to exercising, socializing and leisure – into the home environment.

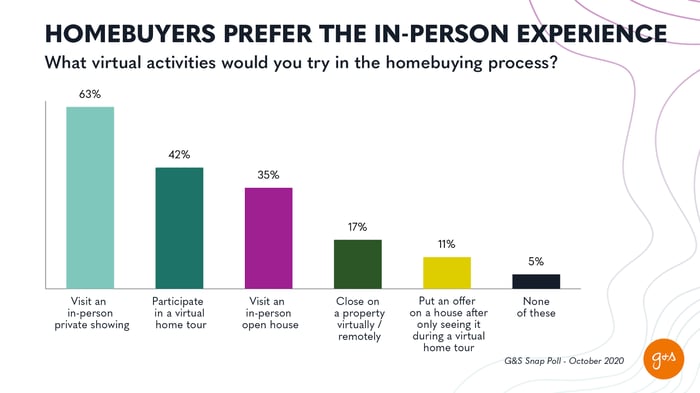

When it comes to home buying, renovating and other services, people are open to technology for consultations, but they still seek the personal connection that comes from in-person showings, tours and visits. Nearly two thirds of consumers (63%) would feel comfortable visiting a potential new home in a private, in-person showing, and 35% would feel comfortable visiting an in-person open house. Yet few people are willing to make final decisions without setting foot in their soon-to-be home: Less than one fifth (17%) of consumers would close on a property virtually, and only 11% would feel comfortable making an offer for a house after viewing it in a virtual environment alone.

Over the next few weeks, we’ll be taking a deeper dive into these trends across each market vertical. Want to learn more about what’s changed and what’s here to stay in your industry? Subscribe to our content to receive the latest updates.

Survey Methodology:

This G&S Snap Poll was administered online in October 2020. The food, healthcare and finance sections were completed by a representative U.S. sample of 1,041 adults aged 18+, while the home renovation and manufacturing sections were completed by a representative U.S. sample of 1,050 adults aged 18+. Both samples have been balanced for age and gender based on the Census Bureau’s American Community survey to reflect the demographic composition of the U.S.